The first major challenge to a startup’s survival is finding investors. However, immediately after this, they face another challenge that’s just as great: setting up the right investment contracts and maintaining an investment structure that keeps the company viable. Many startups don’t see this coming. At Leapfunder, we know that clear contracts and a viable capital structure are vital, just as finding investors willing to take the risk. That is why we offer an Investor Matching Program for just a nominal fee. The program lasts between 30-90 days depending on how fast the startups want to go. The goal is to train founders not just to find investor leads in our network and elsewhere, but also to provide them with the knowledge and skills that are going to enable them to manage their investment round into the future. We build on valuable insights from 150+ successful Leapfunder funding rounds and give you direct access to other entrepreneurs who can openly share their experiences. Even though we can’t guarantee a match with any investor, we can coach founders to find leads, help them set up their terms sheets and pitch decks, and get them in the best possible shape before doing a funding round.

After joining our Investor Matching Program, startups get showcased on our website and introduced to the largest angel investor network in Europe. They get to attend our signature Round Table Sessions, where startups and investors meet informally. They also get to join our online workshops for founders: we offer the Investor Readiness Session where startups can learn how not to talk to investors, the Pitch Deck Clinic where they can learn how to build an effective 10-page “conclusion chain” in a series of simple slides, and the Finance Academy, where they get all the financial knowledge that a startup needs.

All of this is just a service to get startups ready for a funding round. Whether they raise on Leapfunder is a later decision. When a startup raises funding via Leapfunder that means the only thing the CEO needs to do is convince angels to invest, while we take care of everything else. Most startups prefer to go this route, but we don’t hinder a decision to set up a funding round in some other way. We talked to three startups that went through the Investor Matching Program and asked them about their opinion. Check out what are the benefits of joining the Investor Matching Program:

Startup #1

Urban Agrotech sells cost-effective plug-and-play vertical farms to high-end restaurants, resorts, and grocery stores while reducing CO2 emissions significantly, using minimum amounts of water. They have developed the farm within a standard 40′ shipping container. Compared to the most efficient competitor in the market, their system boasts over two times the yield and a remarkable 30% reduction in costs. Find out how the Investor Matching Program helped them.

1. What were the benefits of joining the Investor Matching Program for your startup?

The main benefits were the help and insights we got from Leapfunder to improve our story, and network of investors. With a good understanding of what’s important for investors, Leapfunder helped us to finetune our story.

2. Which part of the program stood out to you the most and why?

The combination of the Weekly Standup Calls and the Round Table Sessions. It’s great to practice talking about your business and hear what people picked up on. We redefined and reshaped our communication strategy. The feedback was honest and clear. The respectable directness gave us valuable insights.

The Round Table Sessions are great for speaking with investors, even if they’re not in your startup’s field. These talks generated valuable feedback and we managed to find some investors that invested in our round.

3. Would you recommend the Investor Matching Program to other startup founders, and why?Yes. I’d definitely recommend the Investor Matching Program. The help we got to prepare our round and the large network of angels definitely got us to reach our first target in the round. Whether you’re new to raising funding or experienced, it’s always good to hear other people’s thoughts to improve.

Startup #2

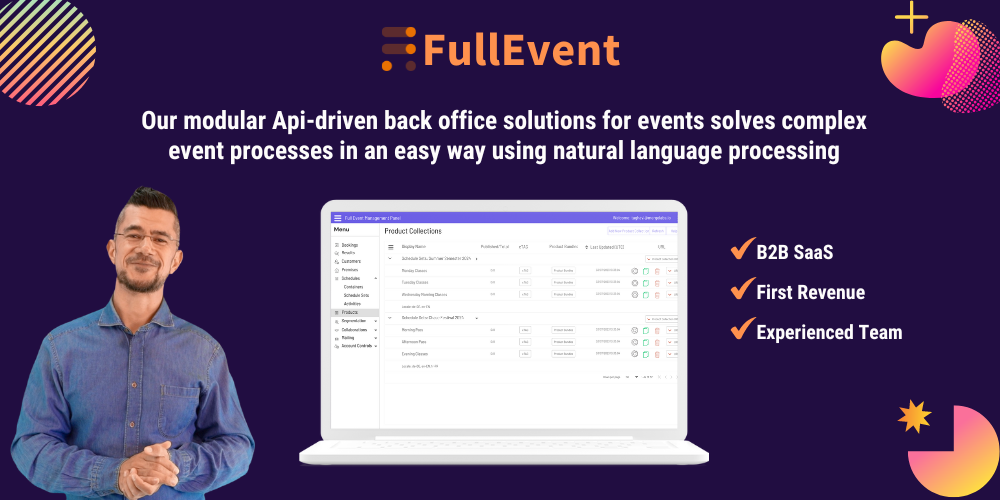

FullEvent is the “Lego” of back-office solutions for event creators. With FullEvent, creators can use one tool to build and manage any event or activity, whether it’s weekly yoga classes, weekend dance festivals, or anything in between. Check out how the Investor Matching Program helped them.

1. What were the benefits of joining the Investor Matching Program for your startup?

The program made us more investible. Investors ask for term sheets, data rooms, the pitch deck, etc… and Leapfunder helped us a lot with preparing all of that.

2. Which part of the program stood out to you the most and why?

The fact that there is a whole infrastructure regarding making a startup investor-ready. The training and coaching, the data room solution, and the investor talks. The calls, the workshops, and the Round Table Sessions were definitely of the most value.

3. Would you recommend the Investor Matching Program to other startup founders, and why?

I always recommend the Invest Matching Program to fellow startup founders. It’s a one-stop solution for getting startups investor-ready.

Startup #3

Beazy is a rental marketplace for audiovisual equipment and spaces. It can be described as the Airbnb for photographers and filmmakers. Customers get easy and cheap access to the equipment and locations they need, while providers make an extra income from their equipment and/or studios. Learn how the Investor Matching Program helped them.

1. What were the benefits of joining the Investor Matching Program for your startup?

We met a lot of investors who invested in our startup, are Beazy shareholders, and are still actively helping us. You get access to a large investor network and Leapfunder gives a lot of useful feedback. The program is not taking a lot of time from founders, so I think it’s definitely worth it.

2. Which part of the program stood out to you the most and why?

The workshops for startup founders were very high-quality and useful for us. The Round Table Sessions helped us meet the investors we needed for the round and honestly, I still haven’t found an event that’s an event comparable to Leapfunder’s Round Table Sessions. Talking to the Leapfunder team gave us reassurance and helped us become investor-ready.

3. Would you recommend the Investor Matching Program to other startup founders, and why?

There’s no reason not to join the Investor Matching Program. We had a very positive experience with not a lot of time invested from our side.

By signing up for the Investor Matching Program, you will get our undivided attention over 30-90 days to put your investor story together and meet first investors through participating in our workshops and coaching sessions. Make sure to get ready to get your funding sorted out professionally.

Join our network of startups & investors!