In this blog post we decided to bring content forward from the “How to Raise Money” lecture by Marc Andreessen (VC) and Ron Conway (Angel Investor). We changed the focus to “How to Invest in Startups”. The aim is to provide the angel investors in Leapfunder’s user base with tips from experienced experts. Here it goes:

What makes you invest in a startup?

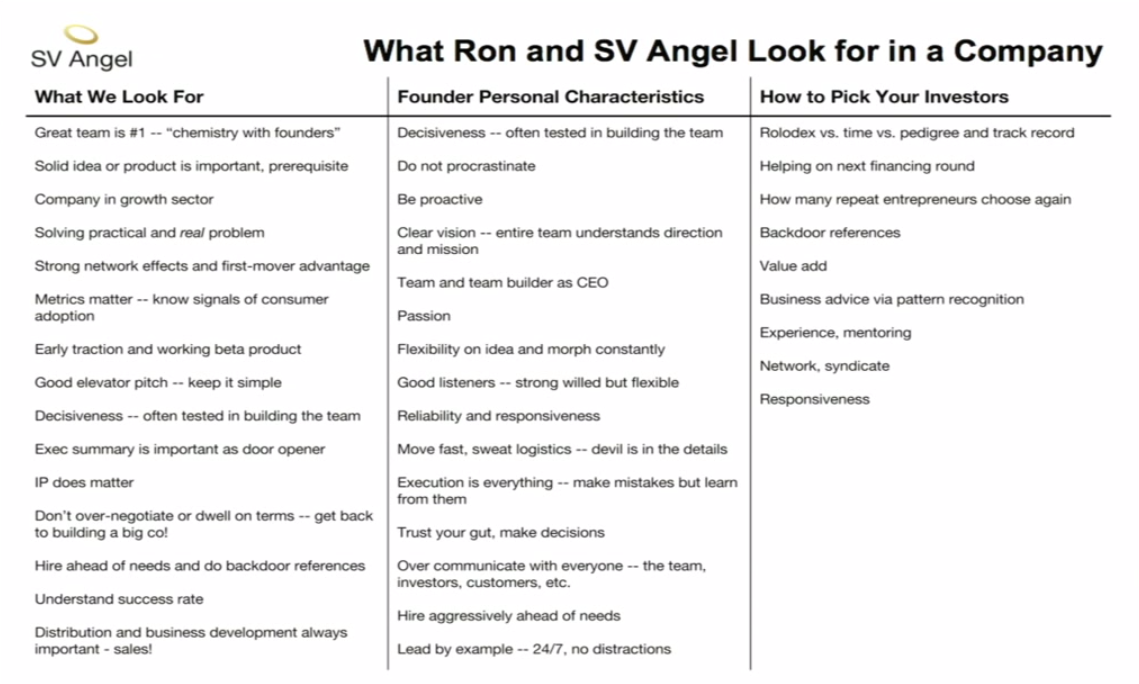

Ron Conway has been investing in startups since 1994, SV Angel and it’s entities have invested in over 700 companies, which means they had to talk to thousands of entrepreneurs. Here are the questions that go through Ron’s head when he meets an entrepreneur:

- Is this person a leader?

- Is this person focused and obsessed with the product?

- Usually, the first question Ron asks is: “What inspired you to invent this product?” Hoping it’s based on a personal problem that this founder had and that his product is the solution to this problem.

- Does the founder have good communication skills? If the founder is going to be a leader and hire a team, he’s got to be a really good communicator, a born leader.

Marc Andreessen explains the venture capital business is a 100% game of outliers- its extreme exceptions. Here is a general concept they focus on when investing in startups:

- Invest in strength vs lack of weakness – instead of checking the boxes (great idea, great founder, etc.), and they aspire to invest in the startups that have really extreme strength in a long and important dimension and are willing to tolerate some of the weaknesses.

- “One of the cautionary lessons of VC is: if you don’t invest on the basis of serious flaws, you don’t invest in most of the big winners.”

To learn more how extremely experienced VCs & Angles think and which tips do they give startups looking for funding, check out the complete lecture here: How to Raise Money

Where do you discover potential startups to invest in?

Both Ron’s & Marc’s companies have a huge network through which they learn about potential startups they would be interested investing in. That may not be available to people who are new to angel investing, for whom we are writing this blog post. Therefore, we would like to share more applicable advice on where to discover potential startups to invest in around Europe:

“I see the highest quality startups around the accelerators or among second/third time entrepreneurs. Keeping up-to-date on what’s going on is one of the reasons for mentoring at the accelerators.” Wouter Kneepkens, Dutch Angel Investor

We also recommend you check out startups currently raising funding on Leapfunder.com, all-star teams are waiting for you to fuel the improvement they’re creating.