The search for new investment opportunities can be a daunting task. It involves knowing where to look and which signals to track to detect the best opportunities. Only if that is successful can one turn to selecting a manageable batch of companies for a balanced portfolio.

Having a strong basic deal flow and a good filter to select the best deals is an essential prerequisite for ultimately building a solid portfolio. It’s especially critical for early-stage investing because there are so many companies in those stages and the failure rate is therefore very high. That means there are many companies to sort through, and substantial risks if you pick the wrong ones.

In this article, we’ll have a look at a traditional way of generating deal flow used by venture capitalists, and suggest a different approach, that is used by Leapfunder amongst others.

The traditional Venture Capital way of handling deal flow

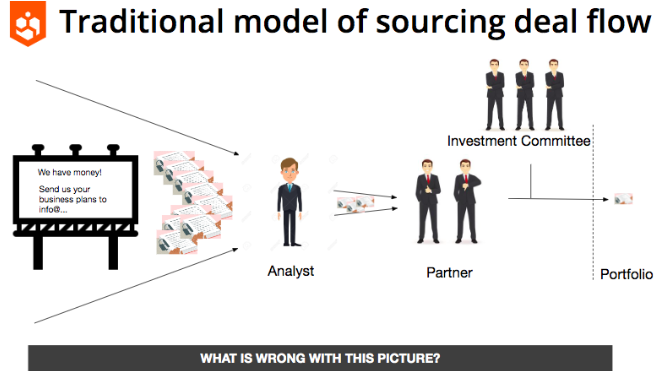

For VCs, a traditional way of handling deal flow is just putting up a sign saying: “We’ve got money. Send us your business plan.” An avalanche of business plans is then received, typically thousands a year. A partner-level investor doesn’t have time to read these, and so there is often an analyst who reads them all. The analyst becomes the eyes and ears of the partner since he picks out the good deals. The analyst has to maintain a very close relationship with the partner who is ultimately controlling the money. Often the partner gives the analyst feedback on the business plans that make it through. When a partner decides to do a deal, he needs to persuade the investment committee, which oversees the partner.

In the image below, you can see exactly how it works. But can you figure out what’s wrong with the process? Continue reading and find out.

What should a good VC portfolio look like?

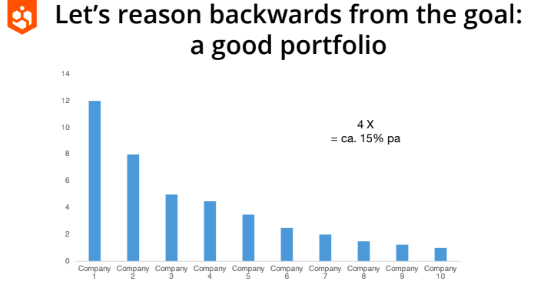

A dream portfolio could consist of, say, ten companies over, say, about ten years (the points that follow remain for larger or smaller portfolios). The investor is looking to maximize returns on the companies that do well. Not all of them will do well. That’s normal. So within this portfolio, let’s say one does a 12x exit. Some others do an 8x, 5x, and 4x exit. The rest of the deals are sort of okay but less spectacular. A possible distribution of returns is shown in the image below.

Overall, this distribution of returns leaves the investor with a total return of 4x, or about 15% per annum. That’s not a bad return.

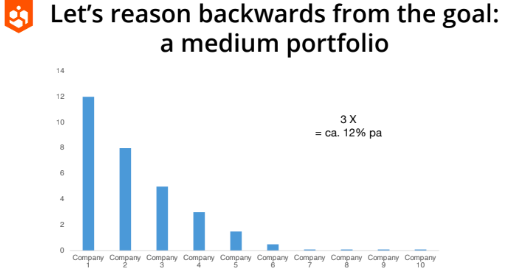

Now let’s look at what happens if the partner picks the same winners for the portfolio, but the mid-level deals turn out a little bit worse. All of a sudden, the overall results drop down to 3x and 12% per annum. That’s despite having the same winners.

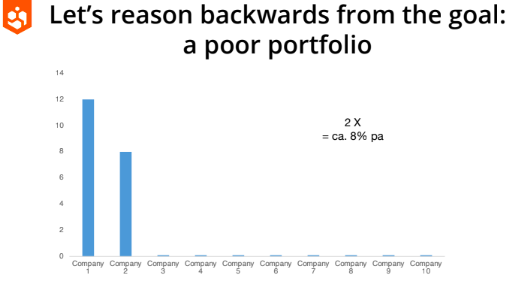

Now let’s look at what happens if the partner picks the same winners, but the mid-level deals are not performing at all. The result is 2x and 8% per annum in this simulation. That’s despite having the same winners.

This means it matters what happens amongst the mid-level performers in a portfolio! The secret to success is partially in getting a better exit from the deals the partner probably almost regrets doing in the first place. If you can exit those at 1x or 2x then you can give a good boost to the performance, because there are relatively many of these deals.

In other words: for a portfolio of startup investments to be successful you need a couple of hits, AND you also need to execute reasonably well with the average deals in the portfolio. Otherwise, you don’t have a base under the platform on which you’re operating.

So what’s wrong with the traditional way of generating dealflow?

In the traditional way of generating deal flow, there is no attempt to improve the overall quality of the business plans that come into the deal flow at the first entry point. Now if you have a lot of fairly bad deals coming in – because you just put up a sign on the internet saying: “We have money! Send us your business plans.” – then it becomes more likely that some of those bad deals will get to the portfolio. That’s even if the filter selecting for good deals is working fairly well.

Since investors have clear incentives to select high-returning deals you would think that the selection mechanisms are always very sophisticated and effective. But is that true? The analyst screening the deals has an incentive to tell the partner what he wants to hear since that is his employer. The partner has an incentive to make sure the investment committee follows his decisions and wishes, otherwise, he loses credibility. The risk of there being synchronization and alignment of knowledge and ideas is substantial. And that’s how a team of people starts missing things, so the filter applied is fairly thin.

There is a saying: “A good startup doesn’t like to spend time on pitching.” Although that claim may not always be true, it certainly has a core of truth. Pitching is usually not a core competence, so a team that is building a great company would likely prefer to spend their time elsewhere. If they are not careful the startup will spend a lot of time preparing a business plan, and presentations, and answering endless investor questions, instead of living with their customers. If investors make their selection based on decks, and pitches they are not adding value to the startups through their process of selection, but even taking value out. That should be a concern to everyone involved.

In summary, we see three main pain points in the traditional process:

❌ Original deal flow quality is not managed: little effort is made to ensure that the original deal flow is overall high quality, so a lot of bad deals are coming into the selection filter

❌ Selection tasks are not value added for the startup: the tasks that startups are asked to perform during selection don’t fundamentally add value to those startups, and so they are an unnecessary cost

❌ People performing the selection are too few and one-sided: the selections are made by a few or even a single “expert” which leads to dubious results since the perspective is limited and cross-checking is biassed

What is an alternative way of working?

✔️ Original deal flow quality is managed: just like a manufacturing Keiretsu will work with supply chain partners, the investor will cultivate specific sources of deal flow, and send feedback upstream to improve the quality of companies that are offered

✔️ Selection tasks are value-added for the startup: the tasks that startups are asked to perform during selection are fun and increase the success chances of the company. That way the startup can take them on with intrinsic motivation

✔️ People performing selection are maximally diverse: the selections are made by a broad audience of investors, who self-select to connect with specific startups. That way interests are matched through a broad market

Leapfunder is known for generating extensive deal flow internationally. When we originally set up deal sourcing for Leapfunder, we laid down that we always want to know exactly where the business plan comes from. When you know where your drinking water comes from then you’ll know how much work is needed to get it clean. That way of working also means we can invest in that source of deals because if a source is a good source, we can go upstream, bring skills and knowledge, and the startups from that source will improve over time.

Subsequently, the tasks that we ask the startup to perform are fun. They help the startup and make sense for the founders. The tasks consist of training and mentoring sessions in which startups can judge their performance in a gamified environment. They get friendly feedback from other startups, and investors, without feeling judged. As they interact with the tasks they are evolving their business strategy based on ideas from the other participants. Satisfaction scores are high.

And while the startups are interacting with other startups, and with investors, they are also getting a clear picture of their investability. No single person has a final judgment about any company, but a broader group of investors gets to pass through feedback with varying levels of intensity. The net result is that the startup gets a sense of where the market is, and when an investor wants to jump on board, they can get in touch.

In the end, angel investors on Leapfunder realize returns that are comparable with first-tier VC returns, at a fraction of the cost and time spent. Meanwhile, the range of different types of startups that find funding is very broad, reflecting the diversity in our angel community. This organic approach to deal selection is yielding real results.

Join our network of startups & investors!